How To Send Money Home from China

November 30, 2021

Sending money home from China is a task that most foreigners fear, but our guide should help make it a little more manageable.

Here’s a look at what you need to know, have and do to send money home from China.

What information do I need to send money abroad?

To be able to send money abroad, you need to provide the following:

- Recipient’s full name as printed on passport/ID/bank account

- Recipient country

- Recipient’s address

- Name and address of their bank

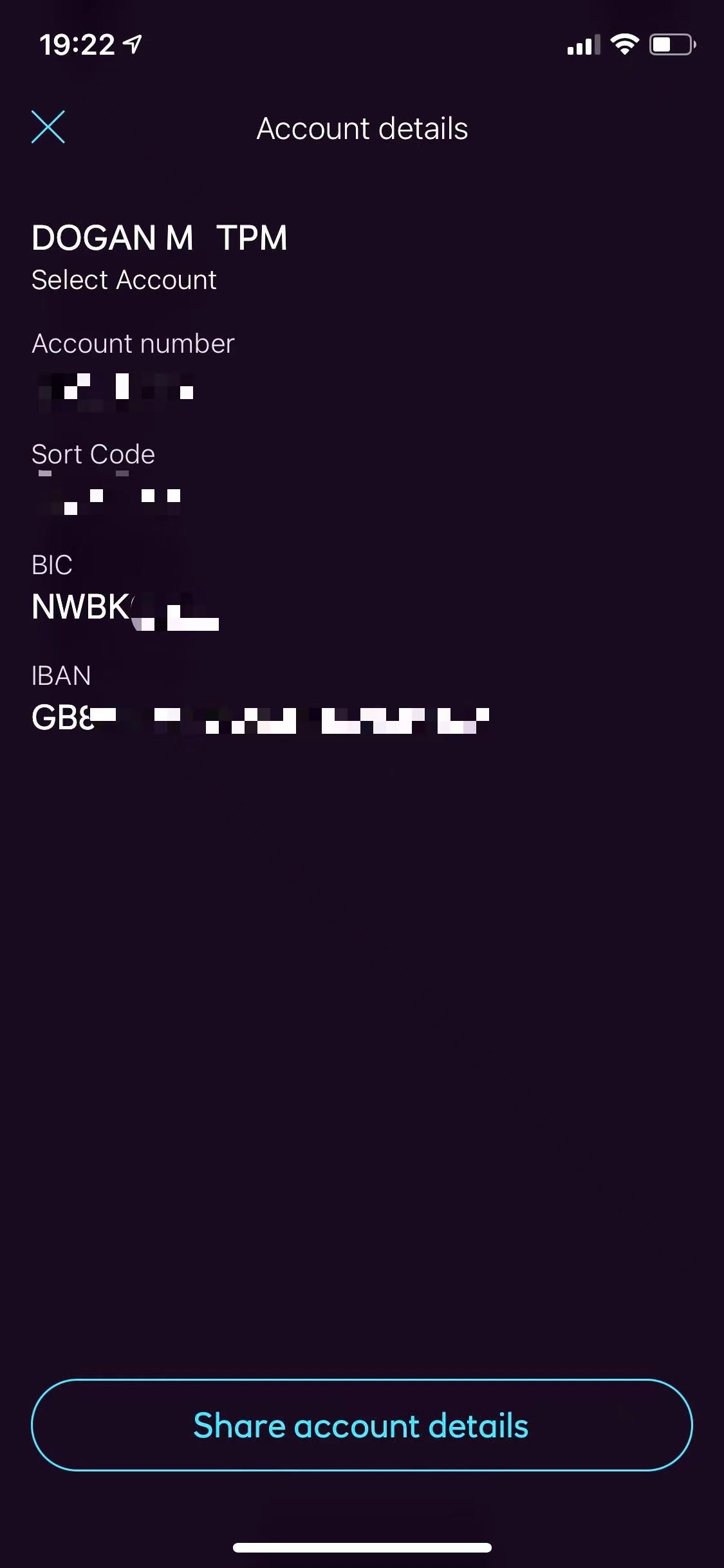

- Recipient’s IBAN and SWIFT codes

Once you have this information, the process can begin.

The process is slightly different depending on the amount, circumstances and method that you use.

Sending home money via the bank

Obviously, as with most countries, sending money home via the bank is the most legitimate, and safest way, but it can be frustrating. The current wire transfer fee is 150 RMB, so no matter which bank you choose, the fee will be the same. However, be aware that the receiving bank will also charge money for the transaction, which varies around the world.

If you have all of the above-mentioned information, and a valid passport, you can wire home up to 500 USD per day. The bank will require a little more time to set up your initial wire transfer, but the process is much faster for repeat transactions.

The bank clerk will initially need to exchange your RMB into the required currency, and then send that currency to the recipient account.

Unfortunately, this can end up being very expensive as you have to pay the 150 RMB transfer fee AND lose money on the exchange rate with each transaction.

Can I send more than 500 USD via the bank?

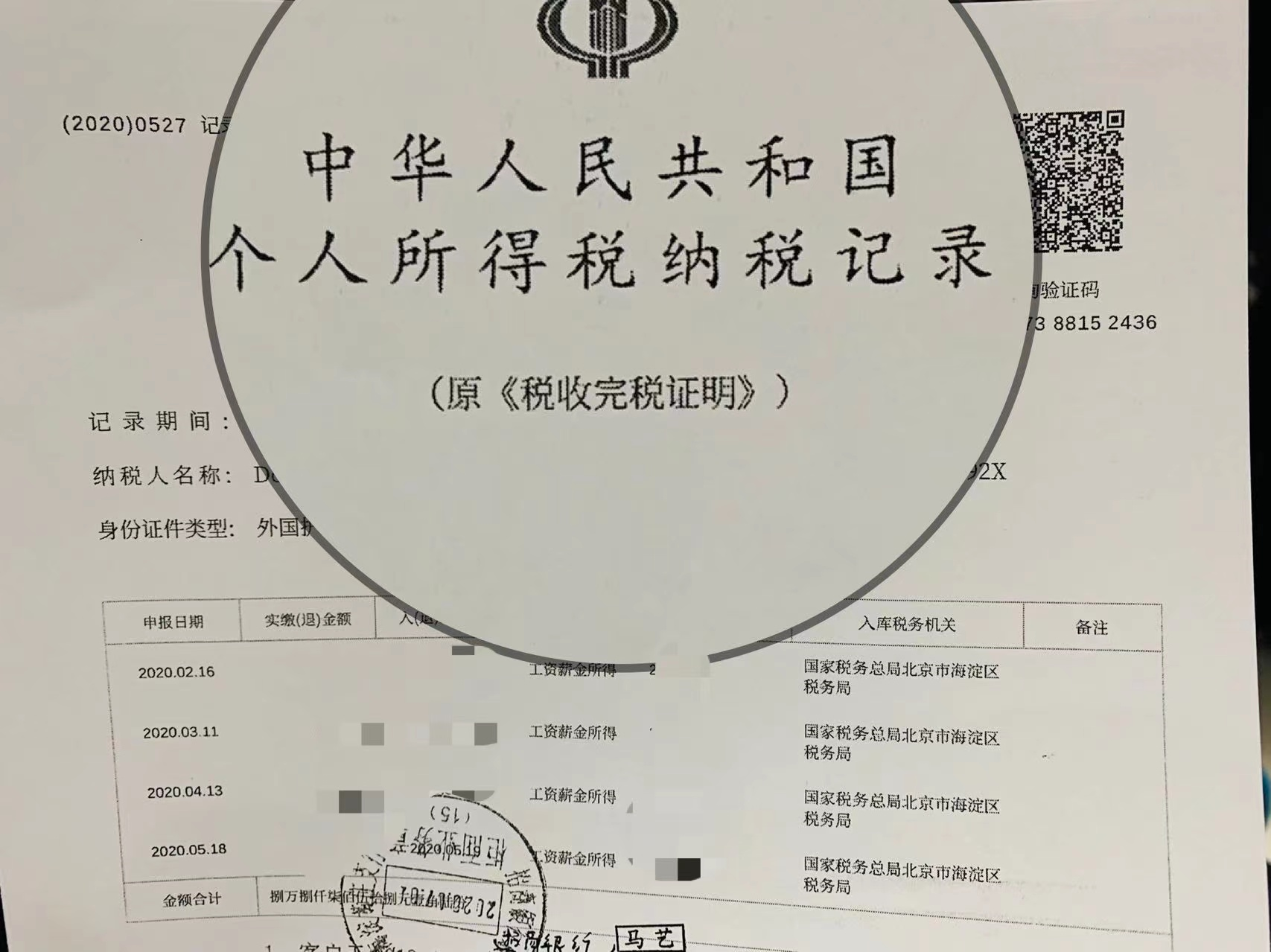

You can send more than 500 USD via the bank, but only with proof of earnings or tax forms.

It is no myth that many foreigners get paid very handsomely in China and are taxed on these earnings. If this is the case for you, then you will need to get a print-out of your tax forms.

Note: You can either go to the tax office to get your tax form (you'll need your passport) or you can use the income tax app 个人所得税 to log in to China's tax website where you can print off the form yourself.

In addition, you will need a signed and stamped income certification (shōurù zhèngmíng 收入证明) from your company, which states what your average monthly or yearly salary is.

A non-Chinese citizen can now send as much as they want, as long as they have been taxed on the amount they are trying to send. Once again though, the aforementioned exchange, transaction and collection fees apply.

Once the transfer is complete, it can take 1-5 days for the money to arrive in the recipient’s account.

Note: some banks require a few working days to check the tax forms, and get clearance for the currency exchange and transfer. For example, CMB (招商银行) tend to require a week for the initial currency exchange. They call you when done, so you can return to the bank to complete the transfer.

Can I use Alipay or Western Union?

Using Alipay and Western Union are definitely much easier, and faster than going through the bank, but they have their own issues.

If you decide to use Western Union, you can send up to 10,000 USD in one wire transfer, which the recipient can collect within 30 minutes of the transaction being completed on your end.

The problem is that you will need to take dollars with you to the Western Union branch. Best place to get USD, yep… the bank. The aforementioned currency restrictions apply once again.

Also, you need to make sure the receiver's name is accurate, otherwise the person you are sending the money to will not be able to collect it.

On Alipay, money transfers can be made with a few simple clicks, only for Chinese citizens, though. So, if you have a trusted Chinese friend who is willing to help, then it is a viable option.

Do I have any other options for sending money home?

Yes, there are a couple of other options for sending money home.

A relatively straightforward method of getting your money out of China is through the use of PayPal. In order to do this, you’ll need to create a Chinese PayPal account and link it to your Chinese bank account. Once set up you can transfer money to either UK or US PayPal accounts.

This is arguably the most expensive method mentioned in the article because of the typically 2% – 3% international transfer fee, and currency conversion fee.

If all else fails, remember that there are plenty of Chinese citizens who are going through the same situation in your country, that you are experiencing in China. If such a person exists among your friend group, you can arrange to give them your RMB, and they return the favor in your country.

This method can be very quick, and much more cost effective for all parties involved. Plus, you don’t need to run around the entire city trying to collect documents.

Whatever method you choose, there is bound to be one that seems viable to you when sending money home from China.

Post contributed by Mehmet Dogan